Stripe vs Zettle

June 27, 2023 | Author: Sandeep Sharma

27

Stripe builds the most powerful and flexible tools for internet commerce. Whether you’re creating a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and unmatched functionality help you create the best possible product for your users.

Stripe and Zettle are two prominent payment processing platforms that cater to businesses of varying sizes and needs. Stripe, renowned for its robust API and developer-friendly approach, offers a comprehensive suite of payment solutions, including online and in-person transactions, subscriptions, and customizable payment flows. Its global reach and support for numerous currencies make it a preferred choice for e-commerce businesses. On the other hand, Zettle specializes in providing streamlined payment solutions for small and medium-sized businesses, emphasizing simplicity and user-friendliness. With its intuitive point-of-sale system and portable card readers, Zettle offers a seamless payment experience for businesses with physical locations.

See also: Top 10 Retail software

See also: Top 10 Retail software

Stripe vs Zettle in our news:

2021. Stripe acquires TaxJar to add cloud-based, automated sales tax tools into its payments platform

Stripe, the privately-held payments company, has recently completed the acquisition of TaxJar, a well-known provider of cloud-based tax services. TaxJar's suite of services enables businesses to automatically calculate, report, and file sales taxes. An important aspect of TaxJar is its ability to navigate various geographies and the complex sales tax regulations associated with each, making it a valuable resource for online businesses. Stripe plans to integrate TaxJar's technology into its revenue platform, alongside its existing tools such as Stripe Billing for subscriptions and Radar for fraud prevention. Additionally, Stripe envisions leveraging AI and other technologies to automate further functions and potentially introduce new services. While TaxJar will be integrated with Stripe's offerings, businesses will still have the option to use TaxJar directly for their tax-related needs.

2018. PayPal acquired Square of Europe - iZettle

PayPal is making a significant move to strengthen its position in point-of-sale transactions, small businesses, and international markets, aiming to compete with Square, Stripe, and other payment providers. The company has officially announced its acquisition of iZettle, a Stockholm-based payments provider often referred to as the "Square of Europe," in an all-cash deal valued at $2.2 billion. Similar to Square, iZettle has successfully established a strong presence in the point-of-sale market by offering a card-reading dongle that seamlessly connects with smartphones or tablets. This has enabled smaller businesses, previously deterred by high card processing costs, to accept card payments. iZettle has also expanded its services to include various financial solutions for these businesses, ranging from inventory management to loans. By acquiring iZettle, PayPal aims to enhance its capabilities and broaden its reach in the evolving payment landscape.

2018. Stripe launched online billing tool

Stripe is introducing a billing solution tailored for online businesses. This new product enables these businesses to efficiently manage recurring subscription revenue and invoicing within the Stripe platform, streamlining their operations. The aim is to replace previously manual methods of invoicing or assembling various subscription tools, offering a seamless experience similar to charging for products on Stripe. This launch is partially motivated by customer requests for a unified solution that consolidates invoices and subscription expenses. As an enterprise company, Stripe prioritizes understanding customer needs while simultaneously innovating to provide elegant solutions for problems that small businesses may not have anticipated.

2015. Mobile POS service iZettle expands to small business loans

Mobile payments provider iZettle, renowned for its mobile card readers enabling small-scale merchants to accept card payments, is diversifying its offerings by venturing into the realm of small business loans. The company has introduced a capital advance solution named iZettle Advance, exclusively available to selected iZettle customers seeking financial support for business expansion. The loan amount will be determined based on individual business circumstances, taking into account factors such as monthly or annual revenue, information which iZettle already possesses due to its involvement in processing the customers' card payments.

2015. Payment processing company Stripe partners with Visa

Payment processing company Stripe has recently completed a financing round, resulting in a valuation of $5 billion. In addition to securing nearly $100 million in funding, the company has formed a partnership with Visa, aimed at collaborating on various initiatives, including digital transactions and security. Stripe has been actively pursuing its global expansion strategy, and this partnership with Visa will play a crucial role in that endeavor. By leveraging Visa's extensive international presence and expertise, Stripe intends to broaden its existing coverage of 20 countries. CEO and co-founder, Patrick Collison, emphasized the significance of this collaboration in expanding Stripe's reach and capabilities, as highlighted in The New York Times.

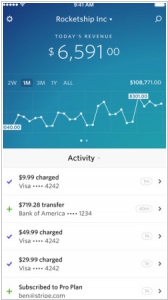

2015. Stripe released iPhone app for monitoring payment activity

Stripe, a payment acceptance service for businesses, has introduced an iPhone app that enables businesses to conveniently track purchases and user activity. This app offers the same functionality as Stripe's existing online dashboard but presents it in a mobile-friendly interface. Users can configure notifications to receive alerts whenever a payment or purchase occurs, as well as set up a daily summary for an overview of the day's activities. Additionally, Stripe's iPhone app includes a search function for easy access to specific information. This mobile application proves to be a valuable tool for busy business owners who may find themselves on the go, whether stuck in traffic, traveling in a taxi, using ride-sharing services like Uber or Lyft (remember not to use your phone while driving), or commuting on public transportation. It provides a quick and convenient way to stay updated on the latest developments in their business.

2015. Stripe gets Balanced customers

Balanced, a payments platform catering to peer-to-peer marketplace businesses, has made the decision to shut down due to insufficient growth. The company has reached an agreement with one of its long-standing competitors, Stripe, to assist with the smooth transition of its existing customers. This closure will impact approximately 320 customers, including prominent platforms such as Tilt (a crowdfunding platform), RedditGifts, Tradesy, Relay Rides, and Artsy. These customers collectively process hundreds of millions of dollars annually. In comparison, Stripe, led by CEO Patrick Collison, handles billions of dollars per year for thousands of businesses across 18 countries worldwide. Balanced faced competition from other industry players like WePay, Dwolla, Amazon Payments, and PayPal.

2014. Stripe - the new king of online payment processing

Stripe, the highly popular payments processing service, has secured $70 million in funding, reaching a valuation of $3.5 billion. Notably, this valuation has doubled in less than a year. Founded in 2010, Stripe initially aimed to simplify online payment processing for businesses. It has since become a key player in powering commerce services for prominent tech giants such as Twitter and Apple, and it will also be responsible for facilitating Facebook's Buy button. Stripe's founder, Patrick Collison, highlighted that when they began, the majority of online transactions relied on outdated banking and merchant infrastructure. He emphasized Stripe's unique approach to addressing this challenge and emphasized their vision of building the foundation for internet commerce.

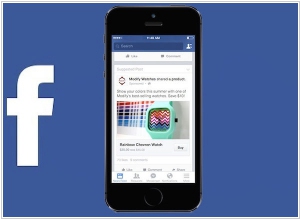

2014. Stripe will power Facebook’s Buy button

Stripe, an e-payments provider, has been chosen to power the "Buy" button for Facebook users who utilize the social network for online shopping. This new button enables users to make purchases directly from ads or posts showcasing products. Confirming the ongoing tests of the new button, a Facebook spokesperson revealed that Stripe is the exclusive payments partner for Facebook in this venture. Stripe has already established payment partnerships with prominent companies such as Apple, Twitter, and the Chinese digital payments service Alipay. Additionally, the company is collaborating with Apple for its recently launched Apple Pay mobile payments service. Facebook has also joined forces with various payments companies for different features, including PayPal's mobile payments unit, Braintree.