Payoneer vs Wise

June 12, 2023 | Author: Sandeep Sharma

See also:

Top 10 Online Payment platforms

Top 10 Online Payment platforms

Payoneer and Wise (formerly TransferWise) are both online payment platforms that offer international money transfer services, but they have key differences in terms of their features and target users.

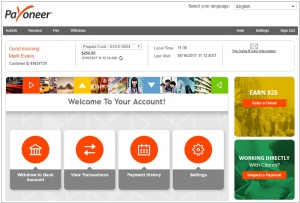

Payoneer is a global payment platform that allows businesses and freelancers to send and receive payments worldwide. It offers features like global bank transfers, virtual accounts, and prepaid Mastercard cards. Payoneer is particularly popular among freelancers, digital marketers, and e-commerce sellers who need a convenient and reliable solution for receiving payments from international clients. Payoneer supports multiple currencies and provides options for withdrawing funds to local bank accounts or using the prepaid card for spending.

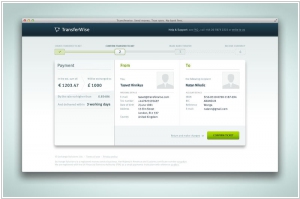

Wise, on the other hand, specializes in low-cost international money transfers and currency exchange. It operates on a peer-to-peer model, which enables users to send money abroad at competitive exchange rates with transparent fees. Wise's primary focus is on providing an affordable and transparent solution for individuals and businesses who frequently make international transfers. It offers multi-currency accounts, borderless cards, and integration with various platforms, making it convenient for managing international finances.

See also: Top 10 Online Payment platforms

Payoneer is a global payment platform that allows businesses and freelancers to send and receive payments worldwide. It offers features like global bank transfers, virtual accounts, and prepaid Mastercard cards. Payoneer is particularly popular among freelancers, digital marketers, and e-commerce sellers who need a convenient and reliable solution for receiving payments from international clients. Payoneer supports multiple currencies and provides options for withdrawing funds to local bank accounts or using the prepaid card for spending.

Wise, on the other hand, specializes in low-cost international money transfers and currency exchange. It operates on a peer-to-peer model, which enables users to send money abroad at competitive exchange rates with transparent fees. Wise's primary focus is on providing an affordable and transparent solution for individuals and businesses who frequently make international transfers. It offers multi-currency accounts, borderless cards, and integration with various platforms, making it convenient for managing international finances.

See also: Top 10 Online Payment platforms

Payoneer vs Wise in our news:

2016. Payoneer raises $180 million for its global payments technology

Payoneer, a leading global provider of payment processing technologies, has secured $180 million in funding to fuel the expansion of its payment services. Despite already being profitable and having a substantial cash reserve, the infusion of capital will enable the company to double its product development and technical workforce, as stated by Scott Galit, the company's CEO. The global market for business payment processing is a significant industry in its own right, with companies like Payoneer, Adyen, Bluesnap, and PayU, all valued in the millions, diligently working on various aspects of the payment challenges faced by businesses engaged in international markets.