Clover vs Zettle

June 27, 2023 | Author: Sandeep Sharma

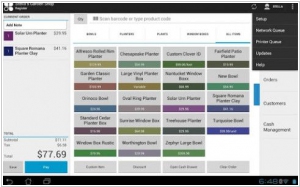

Clover and Zettle are two prominent point-of-sale (POS) systems that cater to the needs of businesses in different ways. Clover offers a versatile and feature-rich POS platform designed to meet the needs of various industries. It provides a range of hardware options, including countertop and portable terminals, along with a suite of software features such as inventory management, employee management, analytics, and integration with third-party applications. Clover's scalability and customization options make it suitable for businesses of all sizes, from small retailers to larger enterprises. Zettle, on the other hand, focuses on simplicity and user-friendliness, particularly for small and medium-sized businesses. It offers a compact and portable card reader that seamlessly integrates with its intuitive point-of-sale system. Zettle's emphasis on affordability and straightforward functionality makes it an attractive choice for businesses with physical locations.

See also: Top 10 Retail software

See also: Top 10 Retail software

Clover vs Zettle in our news:

2018. PayPal acquired Square of Europe - iZettle

PayPal is making a significant move to strengthen its position in point-of-sale transactions, small businesses, and international markets, aiming to compete with Square, Stripe, and other payment providers. The company has officially announced its acquisition of iZettle, a Stockholm-based payments provider often referred to as the "Square of Europe," in an all-cash deal valued at $2.2 billion. Similar to Square, iZettle has successfully established a strong presence in the point-of-sale market by offering a card-reading dongle that seamlessly connects with smartphones or tablets. This has enabled smaller businesses, previously deterred by high card processing costs, to accept card payments. iZettle has also expanded its services to include various financial solutions for these businesses, ranging from inventory management to loans. By acquiring iZettle, PayPal aims to enhance its capabilities and broaden its reach in the evolving payment landscape.

2015. Mobile POS service iZettle expands to small business loans

Mobile payments provider iZettle, renowned for its mobile card readers enabling small-scale merchants to accept card payments, is diversifying its offerings by venturing into the realm of small business loans. The company has introduced a capital advance solution named iZettle Advance, exclusively available to selected iZettle customers seeking financial support for business expansion. The loan amount will be determined based on individual business circumstances, taking into account factors such as monthly or annual revenue, information which iZettle already possesses due to its involvement in processing the customers' card payments.